Ontario Housing Market Becomes a Gateway to Generational Wealth in 2025

Introduction: Building Wealth Through Real Estate in Ontario

The Ontario housing market in 2025 is more than just an opportunity for homeownership—it’s a chance to build generational wealth. With mortgage rates dropping and home prices stabilizing, the barriers to entry for buyers are lower than they’ve been in years. For communities focused on economic empowerment, like those supported by BlackWallStreet.ca, the current market conditions open the door for meaningful investment opportunities. This article will explore how the Ontario housing market is evolving, what it means for wealth building, and actionable steps you can take to seize the moment.

A Snapshot of the 2024 Housing Market: Setting the Stage

Lower Borrowing Costs

The Bank of Canada’s decision to reduce interest rates in late 2024 has had a profound impact on the housing market. Lower rates mean more affordable monthly mortgage payments, allowing more people to enter the market and start building equity.

Stable Prices, Bigger Opportunities

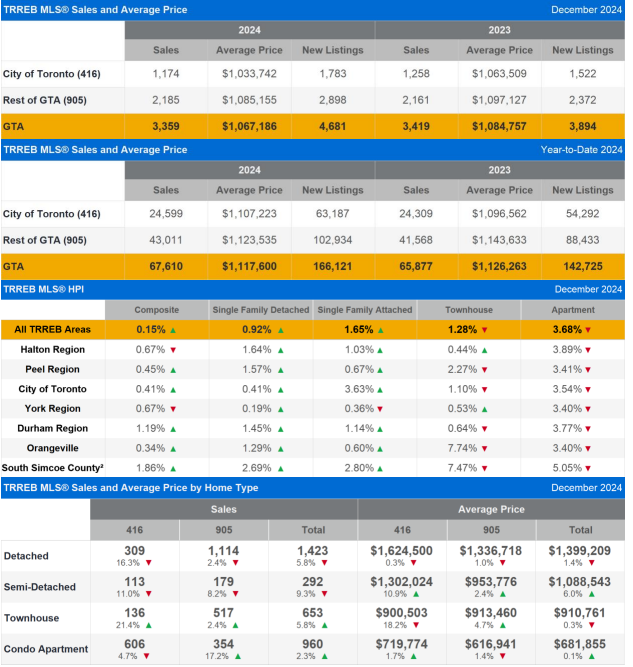

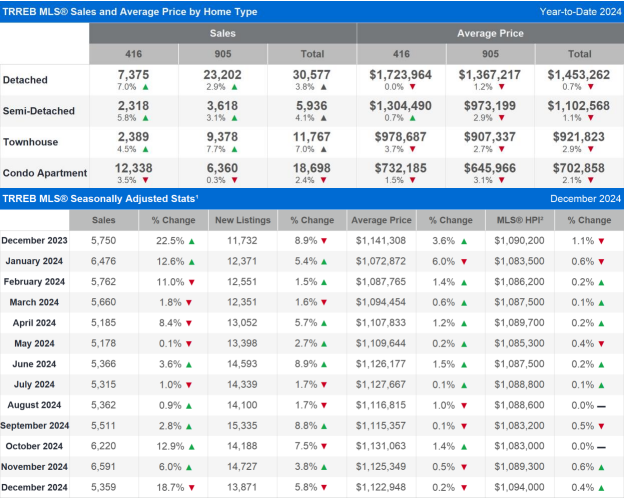

In 2024, the average selling price of homes in Ontario was $1,117,600—slightly lower than the $1,126,263 average in 2023. While prices for detached and semi-detached homes held firm, the condominium market saw notable declines. This trend makes condos an accessible entry point for new buyers, particularly those seeking to maximize their long-term return on investment.

Increased Inventory, Increased Choice

With new listings up 16.4% compared to 2023, buyers in 2024 had access to a wealth of options (Via Toronto Real Estate Board). This trend continues into 2025, giving prospective homeowners and investors the ability to be selective and negotiate favorable deals.

Why the 2025 Housing Market Matters for Wealth Building

Real Estate as a Long-Term Asset

Real estate has long been a cornerstone for building generational wealth. By purchasing property, families can secure an appreciating asset that provides both stability and financial growth over time. With lower interest rates and stable prices, the 2025 market creates a prime environment for this type of wealth building.

Opportunities in Underserved Communities

For Black communities across Ontario, the current market offers a chance to close the wealth gap. By investing in property now, families can begin to build equity and pass down assets to future generations. Condo apartments, with their lower price points, are particularly appealing for first-time buyers looking to enter the market affordably.

Steps to Take Advantage of the Market

1. Research High-Growth Areas

Not all neighborhoods offer the same investment potential. Look for areas with strong infrastructure projects, new developments, and growing job markets. Properties in these locations are more likely to appreciate over time, making them excellent options for long-term wealth building.

2. Work with a Knowledgeable Realtor

Navigating the housing market can be complex, but the right real estate agent can make all the difference. Partner with someone who understands your community’s needs and has experience identifying high-potential properties.

3. Leverage Government Programs

Ontario offers a variety of programs aimed at helping first-time buyers, including down payment assistance and tax credits. Take advantage of these resources to reduce your upfront costs and make homeownership more attainable.

4. Secure Pre-Approval for a Mortgage

Getting pre-approved for a mortgage gives you a clear understanding of your budget and strengthens your position when negotiating with sellers. With rates currently low, locking in a favorable term is crucial.

The Condo Market: A Gateway for First-Time Buyers

Condominiums are an excellent starting point for new buyers and investors. With prices dipping in 2024 and plenty of inventory available, condos offer an affordable way to enter the real estate market. Urban areas, in particular, provide access to amenities and potential for appreciation, making them a smart choice for those looking to build equity quickly.

Overcoming Challenges and Planning for the Future

While the market is favorable, challenges like navigating financing options and understanding market trends remain. Education and strategic planning are key. Resources like BlackWallStreet.ca provide tools and insights to help you make informed decisions and maximize your investment potential.

Conclusion: Turning Market Conditions into Wealth-Building Opportunities

The Ontario housing market in 2025 is ripe with opportunities for building generational wealth. By taking advantage of lower interest rates, increased inventory, and accessible price points, you can secure a property that becomes a cornerstone for your financial future. Whether you’re a first-time buyer or an experienced investor, now is the time to act.

Ready to start your journey toward wealth through real estate? Visit BlackWallStreet.ca for expert advice, resources, and support tailored to your needs.

You must be logged in to post a comment.